Indian Bank IFSC code: The Indian banking system uses several codes to facilitate the fast and accurate processing of financial transactions. Two such codes are IFSC (Indian Financial System Code) and MICR code (Magnetic Ink Character Recognition). While both codes serve a similar purpose, there are some key differences between them. We’ll explain the differences between IFSC code and MICR code and how they are used in the Indian banking system.

Table of Contents

- IFSC code & MICR Code Details for Abhyudaya Cooperative Bank

- How to Search for IFSC Code?

- What is the Abhyudaya Bank’s IFSC code?

- Why is Bank IFSC Code Important?

- What’s Importance of IFSC Code?

- Is Abhyudaya Bank IFSC code different for all branches?

- How can I find the IFSC Code Format for Abhyudaya Bank?

- How can I find the MICR Code Format for Abhyudaya Bank?

- How to Transfer Funds using NEFT, RTGS, and IMPS for Abhyudaya Bank?

- Abhyudaya Bank Services for Online Transactions?

- IFSC Code Allocation by RBI

- Abhyudaya Bank’s IFSC code Services for NRI’s

- How can use SWIFT Code for International Transactions

- How to Apply for Loans in Abhyudaya Bank

- Abhyudaya Bank Loans EMI Calculator

- Abhyudaya Bank Other Services:

Search Bank IFSC & MICR Code for Abhyudaya Co-Op Bank

Find Abhyudaya Nagar Branch IFSC Code & MICR Code

- Get Bank IFSC and MICR Code Details (Used for RTGS, IMPS and NEFT transactions)

- ABHY0065002 Copied!

- 400065002

- Abhyudaya Co-operative Bank Limited

- Abhyudaya Nagar

- Mumbai

- Greater Mumbai

- Maharasthra

- India

- 22 – 24702643

- Abhyudaya Education Society, Opp. Bldg. No. 18, Abhyudaya Nagar, Kalachowky

- Cash, Cheque, Demand Draft & Net banking

- www.abhyudaya.com

Abhyudaya Bank – Customer Support get for IFSC Code

Customers who are uncertain about locating or utilizing the IFSC code for ABHYUDAYA BANK, can refer to the bank’s online resources or reach out to CUSTOMER SUPPORT for guidance.

Abhyudaya Cooperative Bank a prominent cooperative bank in India, provides an extensive range of banking services and products. Our comprehensive guide assists Abhyudaya Bank customers in securely transferring funds using NEFT, RTGS, and IMPS. You will find the necessary IFSC Code and MICR code for seamless and protected transactions.

Credit Score: Check Your Eligibility and Get a Free Credit Score Check – Abhyudaya Bank

Discover the importance of your credit score and how to access a free credit score check. Learn how to check your eligibility for credit and gain insights into your consumer credit score. Empower yourself with the knowledge to make informed financial decisions based on your creditworthiness and access to a free credit score assessment.

Step-by-Step Guide using with IFSC code Transferring Funds with NEFT, RTGS, and IMPS for Abhyudaya Co-operative Bank

Abhyudaya Bank is a trusted co-operative bank in India that provides a variety of financial products and services, including competitive loans and online banking facilities. The IFSC (Indian Financial System Code) and MICR (Magnetic Ink Character Recognition) codes of Abhyudaya Bank can be used while applying for all kinds of loans offered by the bank.

What is the Abhyudaya Bank’s IFSC code?

IFSC code is a unique 11-character code used to identify bank branches participating in electronic fund transfers such as NEFT, RTGS, and IMPS in India. It is an essential component when transferring money online between banks.

Abhyudaya Bank’s IFSC code is universally acknowledged across all three systems facilitated by the Reserve Bank of India (RBI). This distinctive 11-character code serves the purpose of identifying Abhyudaya Bank branches for electronic fund transfers 24×7 transfers, including NEFT, RTGS, and IMPS.

Abhyudaya Bank Holidays List

How can I find the IFSC Code Format for Abhyudaya Bank?

The table on screen lists the IFSC codes for the Abhyudaya Bank, which may be used to locate the codes for NEFT, RTGS, or IMPS transactions. This tool may be used to locate the IFSC codes for Abhyudaya Bank branches all around India. A distinct 11-character IFSC code is assigned to each Abhyudaya Bank branch that accepts online payments. It’s crucial to keep in mind nonetheless that not all bank offices provide online banking services.

You want to know more about IFSC Code Format?

1. An IFSC codeis 11 characters long.

2. An IFSC code is alphanumeric because it combines letters with numbers, creating it.

3. The alphabetical first four characters of the IFSC code identify the bank name. Below is a list of references.

4. The fifth IFSC code character is always “0” and is not currently utilised.

5. The final six characters of the IFSC code are normally numbers, although they can also be letters. They stand in for a particular bank branch.

How can I find the MICR Code Format for Abhyudaya Bank?

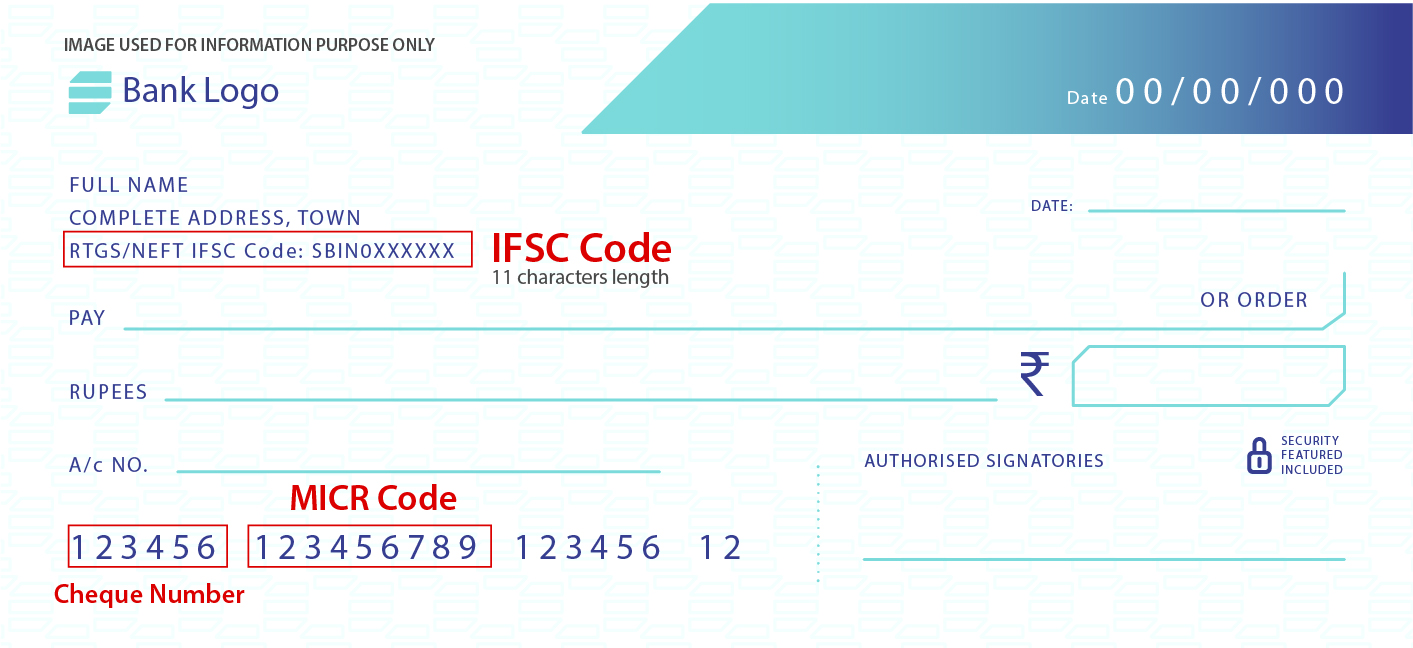

The MICR code format is a 9-digit code used for processing cheques in an automated manner. It is printed in special ink containing magnetic particles, allowing automated systems to read and process cheques accurately and efficiently. The MICR code contains information about the bank, branch, and account details, making it an essential component for cheque processing and verification.

You want to know more about MICR Code Format?

How to Transfer Funds using NEFT, RTGS, and IMPS for Abhyudaya Bank?Abhyudaya Bank supports NEFT, RTGS, and IMPS for electronic fund transfers. To use NEFT or RTGS, you need to provide the beneficiary’s name, account number, and IFSC code. For IMPS, you need the beneficiary’s mobile number and MMID or account number and IFSC code. You can access these services either through internet banking or by visiting an Abhyudaya Bank branch, or simply through their website..

What is MICR Code?

The IFSC code consists of nine digits and is used for identifying bank branches in India. It is structured as follows:

1. City Code: The first three digits of the IFSC code represent the city where the bank branch is located. This code is similar to the PIN code used for postal addresses in India and helps identify the specific city associated with the branch.

2. Bank Code: The next three digits of the IFSC code represent the bank itself. This code uniquely identifies the bank that operates the branch.

3. Branch Code: The last three digits of the IFSC code identify the specific branch within the bank. This code distinguishes one branch from another within the same bank and city.

The IFSC code is a nine-digit code used in India to identify bank branches. The first three digits indicate the city, the next three represent the bank, and the final three digits signify the branch.

Is Abhyudaya Bank IFSC code different for all branches?

No, The IFSC Code is a distinctive alphanumeric code comprising 11 digits that is assigned to each bank branch in the India that participates in electronic fund transfers, including NEFT, RTGS, and IMPS, and Faster Payments.

Example of IFSC Code: While the first four characters of the IFSC code represent the bank code (ABHY for Abhyudaya Bank), the fifth character is always a zero (0). The remaining six characters of the code represent the specific branch code.

Therefore, the first five characters (ABHY0) of the IFSC code remain the same for all branches of Abhyudaya Bank, indicating the bank’s identity. Only the last six characters vary for each individual branch, denoting the branch’s unique identification.

So, the IFSC code of Abhyudaya Bank will differ for each branch, but the first five characters will always remain the same.

Why is IFSC Code Important?

The IFSC (Indian Financial System Code) plays a crucial role in facilitating electronic money transfers and online banking transactions. Here’s why the IFSC code is important:

1. Facilitates Online Transactions: The IFSC code is a mandatory requirement for conducting any online bank transaction. Whether you are transferring funds through NEFT, RTGS, or IMPS, the IFSC code ensures the smooth processing of payments between different bank branches across the country.

2. Record Maintenance by RBI: The Reserve Bank of India (RBI) maintains records of all bank transactions using IFSC codes. This enables the RBI to identify, monitor, and authenticate fund exchanges during banking transactions, ensuring transparency and security.

3. Accurate Identification of Receiver’s Bank Branch: When initiating a transfer through NEFT, RTGS, or IMPS, the IFSC code provides precise information about the bank branch where the recipient’s account is held. This ensures that the funds are directed to the correct branch and account.

4. Ensures Security and Paperless Transactions: The use of IFSC codes prevents unauthorized fund transfers, as a valid code is required to initiate transactions. Additionally, online transactions conducted using IFSC codes are environmentally friendly, as they eliminate the need for physical paperwork.

5. Facilitates Business Growth: The efficient functioning of IFSC codes contributes to the overall growth of the country by facilitating fast and secure business processes. It enables businesses to make seamless transactions and ensures the smooth flow of funds.

6. Payment Convenience: Apart from fund transfers, IFSC codes can be used for various payments, including travel bookings, bill payments, and online bookings. This provides a convenient and reliable method for making payments using the unique identification of bank branches.

Abhyudaya Bank Services for Online Transactions?

The convenience of online payments has significantly enhanced people’s lives. With a few simple clicks, individuals can effortlessly perform various transactions such as premium payments, bill payments, ticket bookings, donations, shopping, and more.

CIBIL Score: Check Your Eligibility and Get a Free CIBIL Score Check – Abhyudaya Bank

Take control of your financial health by checking your CIBIL score. Discover how to check your eligibility for a CIBIL score check and gain access to a free CIBIL score. Understanding your consumer cibil score is crucial for making informed financial decisions and accessing favorable loan terms. Start monitoring your CIBIL score today and pave the way for a brighter financial future.

IFSC Code Allocation by RBI

It is a common misconception that banks create their own IFSC codes. However, the reality is that the authority to allocate and generate IFSC codes lies solely with the Reserve Bank of India (RBI). The RBI is responsible for assigning unique IFSC codes to different banks across the country, ensuring a standardized system for online fund transfers.

To obtain the IFSC code of a bank, you can conveniently visit the official website of the Reserve Bank of India (RBI). In the footer section of the website, you will discover a designated link that leads you to a page enabling you to select your desired bank from a drop-down menu. By entering the branch name, you can effortlessly retrieve the specific IFSC code and MICR code for any branch located within India.

By centralizing the allocation of IFSC codes & MICR codes, the RBI maintains a comprehensive record of codes for various bank branches. This centralized system enables smooth and seamless online fund transfers, enhancing the efficiency and reliability of banking transactions.

Remember, whenever you need to find the IFSC code for a specific bank branch, you can rely on the official RBI website for accurate and up-to-date information.

Indian Banks Short Names & Balance Check Codes

All Bank short names and balance check codes are important for customers to quickly access their account information through mobile phones. These codes are unique for each bank and can be used to check account balances, mini statements, and other account-related information. It’s a convenient way for customers to keep track of their finances without having to visit the bank branch. ALL banks Short Names & Balance Check Codes

Abhyudaya Co-operative Bank’s Online Services for Non-Resident Indians (NRIs)

Why is there a separate IFSC code for Abhyudaya Co-operative Bank’s Non-Resident Indians (NRIs)?

Abhyudaya Bank offers all range of services to Non-Resident Indians (NRIs) to meet their banking needs. Abhyudaya Bank offers a range of services to NRIs to meet their banking needs. NRIs can open NRE and NRO accounts to manage their Indian earnings and savings. The bank also allows NRIs to deposit foreign currency in their FCNR accounts. Additionally, Abhyudaya Bank provides remittance services to enable NRIs to transfer funds from overseas to their Indian accounts. These services ensure that NRIs can manage their finances in India efficiently and hassle-free.

How does the IFSC code differ for Non-Resident Indians (NRIs) compared to regular customers of Abhyudaya Co-operative Bank?

The IFSC code for Non-Resident Indians (NRIs) of Abhyudaya Co-operative Bank differs from that of regular customers. The variation lies in the specific code assigned to NRIs, which distinguishes their banking transactions from those of resident individuals. This separate IFSC code ensures accurate identification and smooth processing of transactions specifically related to Non-Resident Indians (NRIs) within the Abhyudaya Co-operative Bank system.

Benefits of SWIFT Codes for International Money Transfers

SWIFT codes enable Indians to send and receive money internationally. If you need to receive funds from abroad, providing your bank’s SWIFT code ensures that the funds are correctly routed to your account. Similarly, when sending money overseas, knowing the recipient’s bank’s SWIFT code ensures that the funds are directed to the correct account.

Abhyudaya Bank’s: House, Personal, Education, and Car Loans with Low-Interest Rates

The Abhyudaya Co-operative Bank furnishes the essential IFSC and MICR codes, along with other pertinent details, to customers who apply for a loan. These codes enable customers to conveniently transfer funds to their accounts or make loan repayments to the bank.

How to Apply for a Loan at Abhyudaya Co-operative Bank Using IFSC and MICR Codes:

These codes are required in order to transfer loan amounts from the bank to the customer’s account or the other way around. The MICR code is used to handle checks linked to loans, whereas the IFSC number is used for electronic cash transfers via NEFT, RTGS, and IMPS.

Abhyudaya Bank provides a variety of loan solutions to satisfy the different financial needs of its customers. The bank provides low-interest home loans, personal loans, student loans, and automobile loans. To fulfil the different financial demands of its clients, Abhyudaya Bank offers a variety of loan alternatives at low interest rates with flexible repayment choices.

Abhyudaya Bank’s – House Loans/Home Loans

Abhyudaya Bank’s – Personal loans

Abhyudaya Bank’s – Car Loans

Abhyudaya Bank’s – Education Loans

Abhyudaya Bank’s – Mortgage Loans

Visit for more information of Abhyudaya Bank official website: www.abhyudaya.com

Conclusion of the IFSC & MICR Code

In conclusion, the provided website offers information about the IFSC code for the Abhyudaya Cooperative Bank Mumbai, specifically for the Abhyudaya Nagar branch. Customers can visit the website to access the IFSC code and use it for their banking transactions or any other relevant purposes.

1. How to get the correct IFSC code?

Cheque leaf: To find IFSC code of your branch of Abhyudaya Co-Op Bank, the simplest way is to refer to your cheque book. The full address of the branch is mentioned at the top left corner of a cheque leaf. At the end of the address, you will find an 11-digit code. This is your IFSC CODE.

2. How to double-check the IFSC code during the transaction?

When conducting a transaction, it’s important to double-check the IFSC code to ensure accuracy. Verify the code you entered and confirm the associated branch details. If uncertain, seek assistance from Abhyudaya Co-Op bank’s customer support or visit the branch directly. Consider performing a small test transaction to validate the correctness of the IFSC code before proceeding with larger payments. These steps help minimize the risk of errors and ensure a smooth transaction process.

3. Why created the IFSC & MICR code for Indian Bank’s services?

The IFSC code and MICR codes were created to improve efficiency and accuracy in Indian banking services. IFSC codes ensure correct branch identification for electronic fund transfers, while MICR codes automate check processing.

4. How to get the accuracy of the IFSC Code for online fund transfers?

Consider a small test transaction for validation.

- Cross-check with official sources like RBI or bank websites.

- Verify branch details associated with the code.

- Contact customer support if unsure.

- Consider a small test transaction for validation.

5. Why The Reserve Bank of India assigned 11 characters to the IFSC special code made up of letters and digits?

The Reserve Bank of India assigned 11 characters to the IFSC code, comprising letters and digits, for uniqueness, standardization, and efficient electronic fund transfers. It ensures each bank branch has a distinct identifier and simplifies transactions across different banks. The code structure represents the Abhyudaya Co-Op Bank and branch information.